How to manage the withholdings certificate?

Through the withholdings certificate process, we can upload the certificates of employees in a single and joint PDF, where the platform will distribute them in each employee's profile.

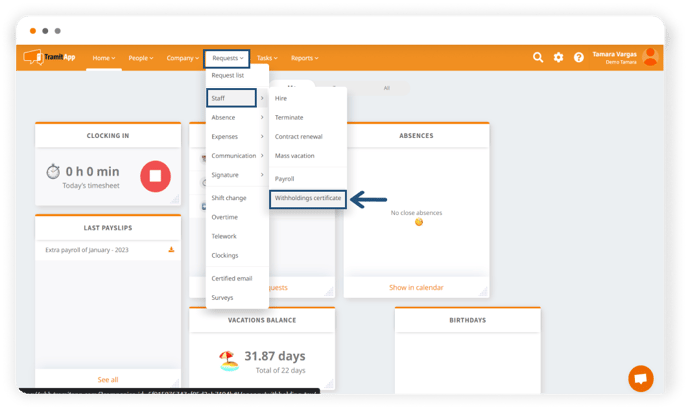

To manage the retention certificates in TramitApp, we should look for the option of Requests > Staff > Withholdings Certificate.

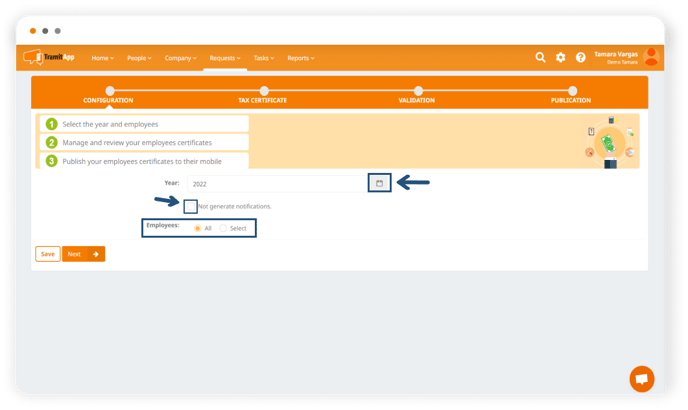

In the new screen that will appear, we must select the year for which we want to inform the certificate and which workers (we can choose All or Select, marking the employees on our payroll we want). We can also determine through the check if we want this process to generate notifications to employees when published. If we want to send notifications, we should leave the check unmarked.

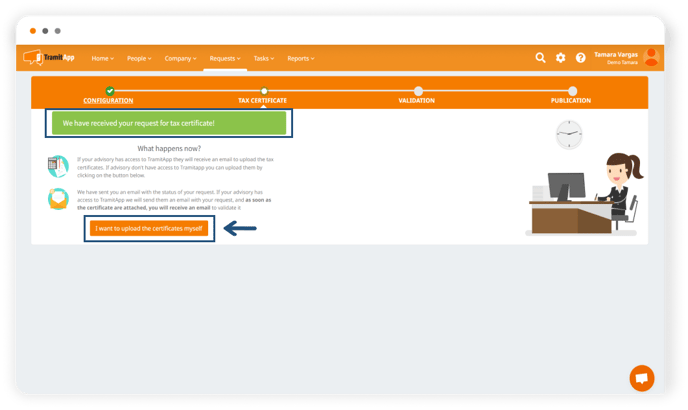

In the next step, TramitApp will have sent the retention certificate request. If our consultancy has access to TramitApp, they will receive the email to upload the certificates. From here, the consultancy will continue with the management. If we do not have a consultancy user, we must click the lower button I want to upload the certificates myself to continue managing it ourselves as administrative users.

Things to consider when uploading withholdings certificate

The .pdf document with the retention certificate of employees should be at least one, showing all the retentions of all the employees indicated in the first step shown. The document must be in .pdf format, without restrictions or passwords, and always in text format so that the platform can extract the information.

➡️For example, the platform will not recognize a scanned document or an image of the retention certificate.

In the case of an employee having two certificates, it is important to upload them in the same PDF, and the system will place both retention certificates directly in their profile.

Uploading the withholdings certificate document

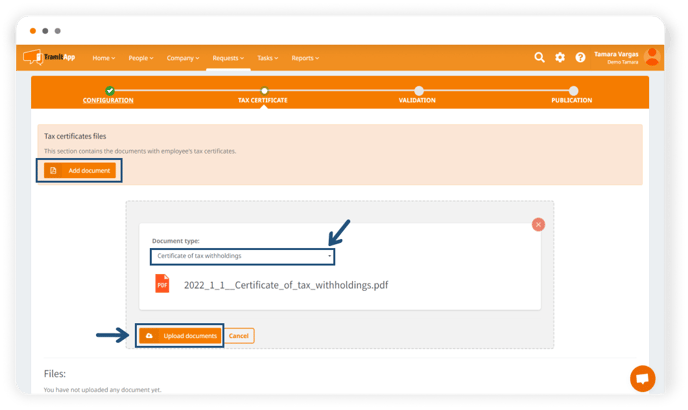

We must click on "Add document" to select the document or documents on the computer where the retention certificates of the employees we have indicated in the first step (or all of them if we set it up that way) are.

We will mark the document type, in this case: certificate of tax withholdings. And we will click on Upload documents for the platform to process them.

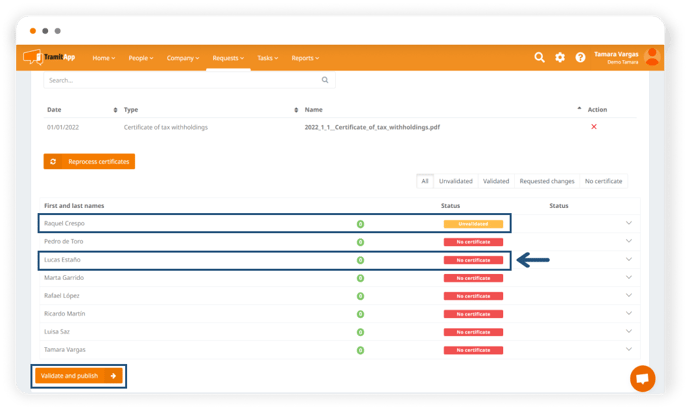

- After the process is complete, where the system has identified an employee by their ID, it will have placed the retention certificate and will display "unvalidated." We will do this step later.

- Where it indicates "there is no certificate" it means that the platform has not found the employee's retention certificate in the PDF that we have uploaded and, therefore, has not placed it.

- If we consider that it is not correct to indicate "no certificate," we should review the document we have loaded to know if it complies with the aspects described above and that the ID reported in the PDF is correct according to the ID each employee has recorded in their profile on the platform.

If this step were performed by the consultancy, an email would be sent to the administrators indicating that the certificates are pending validation. In the case of having uploaded the certificates directly, we can check that they are all correct and that none appears as "no certificate". Once we have done this, we click on "Validate and Publish," a button located at the bottom of the page.

Sending and viewing the retention certificate

At this point, the retention certificate documents are divided relating the ID or Passport that appears in the certificate's PDF with the ID number or Passport that appears in the employees' profiles in TramitApp. TramitApp divides the retention certificate document into individual PDFs and saves them in each employee's profile where it corresponds, so they can consult it.

Employees can view their retention certificates from My Profile > Documents > Payroll and Retentions.

What to look for if the certificates are not being uploaded?

If we see that the withholding certificates are not being uploaded and appear as "certificate does not exist", it may be due to one or several of the following aspects that we should review:

- That the DNI on the certificate and the DNI on the platform match.

- That there are no spaces between the numbers and the letter in the DNI, neither in the certificate nor in the platform.

- That the "foreign document" check is not marked on the certificate.

- That the PDF of the withholding certificate has no restrictions, is in text format so it can be read, and has no password.

- That scanned or image withholding certificates cannot be read