Configure the mileage policy

In this article, we teach you how to configure the company's mileage policy and how to assign it to a specific work center.

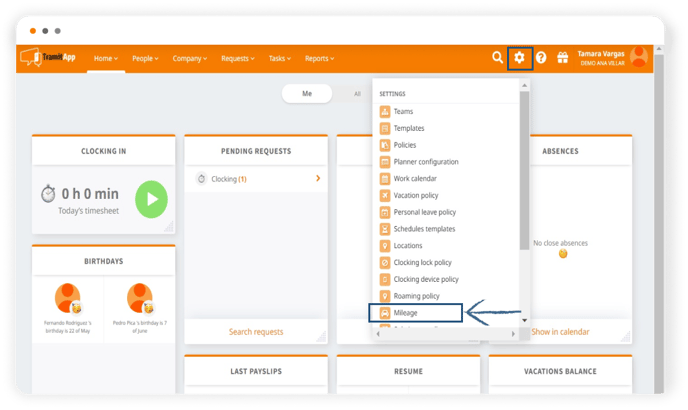

To configure our company's mileage policies, we have to click on the Configuration wheel > Mileage.

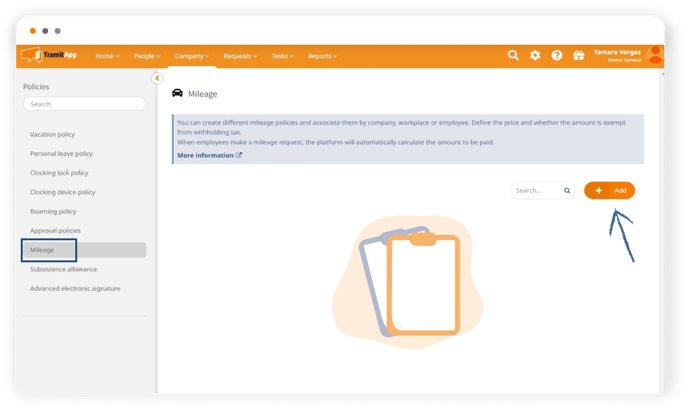

Here we can create as many mileage policies as we need. We click on Add to create a new one.

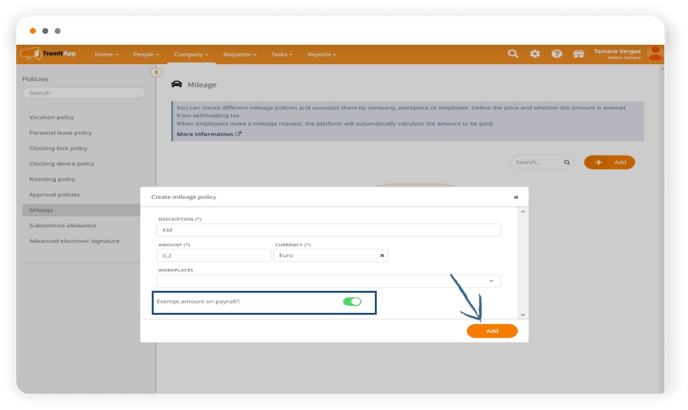

We indicate the name, the amount we want to establish (for example 0.20), and we have the option of marking the exempt amount in payroll check. By marking this check, "Exempt amount on payroll?", when an employee generates a mileage transaction having this policy assigned, the mileage and corresponding price that is exempt from taxation will be displayed, as well as the amount that is not exempt from withholding and therefore creates a payroll incidence. This data is purely informative. We also have the option of assigning this mileage that we have configured to a specific work center or centers. By indicating this, what we do is associate this policy with the people who are part of this work center. We click on Add to save and we will have our mileage policy configured.

Assign the mileage policy to an employee

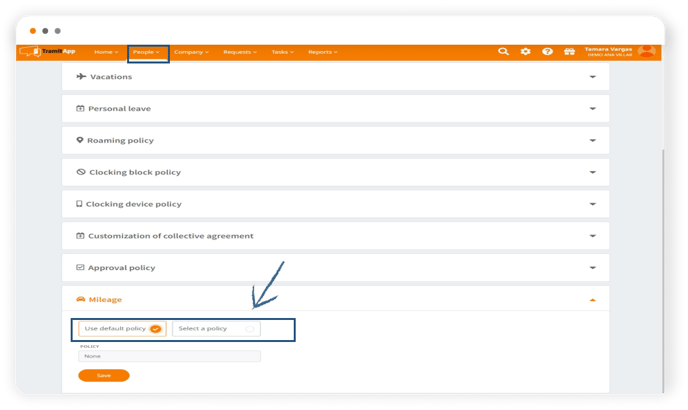

As we have seen in the configuration of other policies, these policies, in addition to being assigned for the whole company or by work center, we can establish it at the employee level, within the profile of each employee in the Mileage section > by unchecking the default check and indicating from the drop-down the one that corresponds.

Next, we are going to see how to consult these incidents, in the employee profile from People > Incidents tab and we will see this employee's mileage transactions.

We have two different transactions:

- One of them was performed by choosing a policy that has the "Exempt amount in payroll?" check marked, so on the one hand it shows us the amount of mileage that is exempt and on the other hand the part that is not exempt.

- The other mileage transaction corresponds to a policy where we have not marked the exempt in payroll check, so it will only inform us of the part that is not exempt, which would be here and therefore if it has withholding.